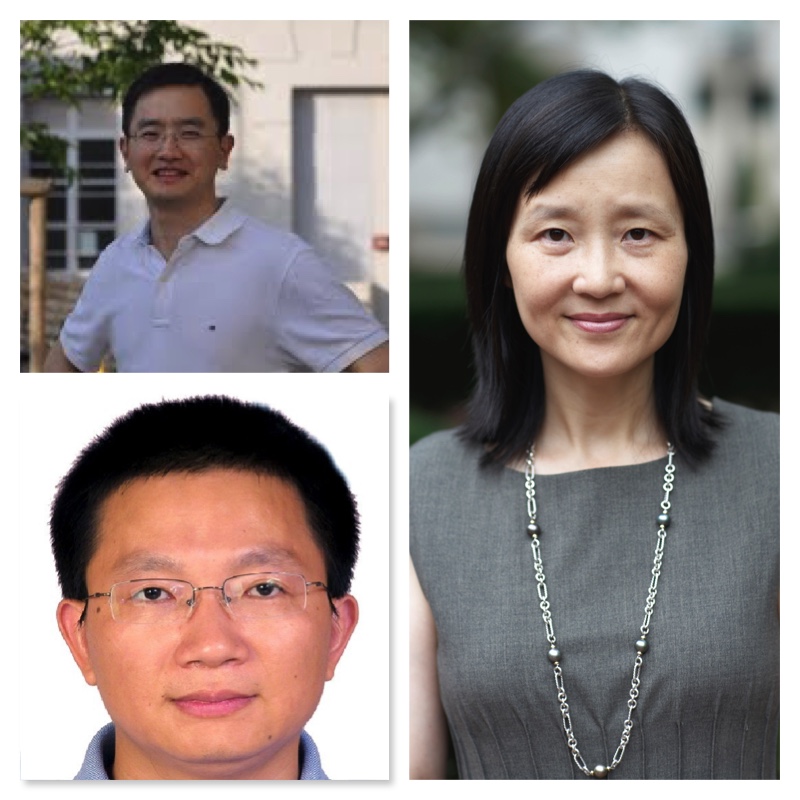

Professors Wei Jiang at Columbia Business School (pictured, right), Hualin Wan at Shanghai Lixin University of Commerce (pictured, bottom left), and Shan Zhao at Grenoble Ecole de Management (pictured, top left) have authored the paper Reputation Concerns of Independent Directors: Evidence from Individual Voting, to be published in the Review of Financial Studies. Following is the abstract from the paper:

This study examines the voting behavior of independent directors of public companies in China from 2004 through 2012. The unique data at the individual-director level overcome endogeneity in both board formation and proposal selection by allowing analysis based on within-board proposal variation. Career-conscious directors, measured by age and the director’s reputation value, are more likely to dissent; dissension is eventually rewarded in the marketplace in the form of more outside directorships and a lower risk of regulatory sanctions. Director dissension improves corporate governance and market transparency primarily through the responses of stakeholders (shareholders, creditors, and regulators), to whom dissension disseminates information.

To read the full paper, click here.