What started out as a vision to help key mutual fund stakeholders understand how evolutions in the capital markets, in governance practices, and in the regulators’ activities and expectations were affecting fund groups’ valuation operating models has now developed into a rich source of information highlighting emerging, maturing, and stabilized industry valuation trends and practices.

Our initial total of 47 fund group participants in November 2001 has grown to between 90 and 100 fund groups in recent years. While valuation has remained a perennial hot topic, our survey findings over the years show the commitment by the industry toward enhancing fair valuation practices, policies, and procedures as well as the valuation operating model. Together, we’re anticipating challenges and finding and sharing new ways to overcome them. As with the 1st edition of the Deloitte Fair Valuation Pricing Survey, the 20th edition provides general benchmarking for fund groups and fund directors as they move forward and enhance their valuation operating model.

The evolution in board governance over our 20-plus years together has persevered and strengthened through unprecedented global events that have included wars, market crashes, credit crises, regulatory scrutiny and rulemaking, pandemics, and scandals. In almost all cases, fund directors have taken these events and used them as lessons learned to up their game and to gain a seat at the decision-making table when price uncertainty exists in the market, always finding a new path forward.

It is ironic that the beginning of our survey journey slightly predated the regulatory crush around market timing, with a focus then on the valuation of foreign equities and the Securities and Exchange Commission’s guidance on subsequent events, and ends with the first substantive valuation guidance in over 50 years through the adoption of the SEC’s Rule 2a-5 on Sept. 8, 2022. The Rule, viewed by many to be prescriptive and a board valuation governance roadmap for fund directors, seems to have subsumed many of the emerging, maturing, and industry governance trends in the survey findings. In fact, the rule proposal cited Deloitte’s survey half a dozen times in reference to existing trends and practices.

Perhaps the board valuation governance themes that have emerged and matured most in the survey’s 20 editions are in the areas of board involvement and structure, active oversight, and board reporting.

Board Involvement and Structure

Early surveys framed board valuation governance involvement and structure as a full-board activity, as noted in the 3rd edition, whereby fair value decisions were reported to the full board by 85% of fund group participants. Over time, this changed dramatically to a fair valuation governance model that delegated responsibility for overseeing valuation matters to a separate a committee, such as valuation, audit, or risk. The percentage of fund group participants taking this approach grew from 56% in the 4th edition to 74% and 77% in the 12th and 19th editions, respectively. Obviously, the continued regulatory focus and scrutiny, and the increase in complexity, attributed to this as boards found the time spent on valuation increasing and the need to be laser focused necessary.

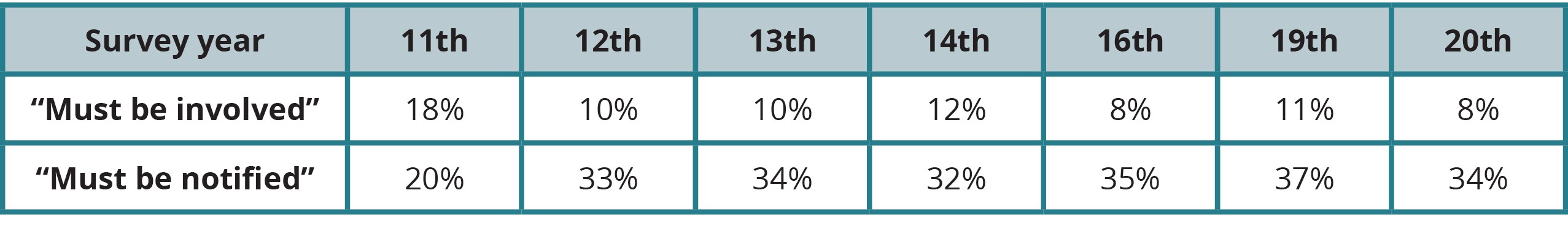

Interestingly, a parallel trend occurred over fund valuation governance, as the 1st edition noted that more than 40% of non-affiliated directors participated in the fund group’s fair valuation committees, and 18% of the time fair valuation decisions were reported “real-time.” This “real-time” fund director involvement trend decreased in future surveys, to 8% in the 16th edition and only 4% in the 19th edition. In addition, the role of the chief compliance officer and chief risk officer/risk committee became more involved in the valuation operating model and a key source of information and reporting for fund directors.

Active Oversight

Active oversight may be a term frequently mentioned in Rule 2a-5, but findings in the surveys have shown continued and escalating active involvement by fund directors. This perhaps starts with the valuation policies and procedures themselves; SEC guidance suggested that detailed and specific valuation policies and procedures may require less oversight, but the opposite was true for board-based valuation policies and procedures. In our first survey, 85% of participants indicated that their fair valuation policies and procedures were characterized as broad-based, meaning they only included general guidelines.

Regardless of the starting point, year over year we saw fund directors oversee and approve changes to the fair valuation policies and procedures. In fact, over the 20 editions the smallest percentage of fund groups making changes to their policies and procedures was 54% in 2021, and the highest was 84% in 2010. Interestingly, the three years with the highest percentages—84% in 2010, 78% in 2013, and 74% in 2014—all followed events that triggered valuation action: the economic crisis, the Morgan Keegan board enforcement, and the proposed money market fund rule, respectively.

Although the segment of fund directors that had an active daily role in the fair valuation determinations remained relatively constant (between 7% and 11% in the middle survey years), three oversight tools at fund directors’ disposal began to shape active oversight. These maturing active tools include (1) upfront agreement with management and the inclusion of wording into the valuation policies and procedures of those instances where a fund director “must be involved” or “must be notified” in a valuation; (2) the emergence of “ad hoc” meetings to discuss valuation issues; and (3) a significant shift in board valuation reporting.

First, the formalization of fund directors sitting at the discussion table emerged in the 8th edition, which showed that 23% and 33%, respectively, of fund groups identified situations where a fund director “must be involved” or “must be notified.” The reasons/triggers for such governance action have remained consistent, while the type of action/involvement matured over subsequent surveys. The top reasons/triggers tended to be as follows:

- The pricing of any holding that is fair valued internally (individually or in the aggregate) exceeds a pre-determined materiality threshold.

- A holding is first fair valued internally.

- A fund holding is priced when a pre-determined event occurs, including if trading of the position halts, the issuer declares bankruptcy, or some similar occurrence.

Overall, the maturing trends we saw in the survey findings represented a move away from “must be involved” toward “must be notified” as noted by the chart below.

Several themes may explain the above industry trend. Valuation policies and procedures became more detailed as they incorporated lessons learned from years of valuation experiences, reducing the need for “real time” fund director involvement. Also, the emergence of the “ad hoc” meeting to discuss a valuation matter—for example, the Russian/Ukraine invasion—may also have contributed to the trend. Yes, simply pick up the phone, send an email, and have a clear, concise “real-time” conversation on a situation that may impact fund holdings. Obviously, those survey participants having “ad hoc” meetings with fund directors are impacted by the number of valuation events that might occur in a particular year. For example, in the 15th edition in 2017 these meetings occurred at 28% of the fund groups; they occurred at 22% in the 16th and 17th editions, and at 39% in the 14th and 20th editions.

Topics discussed on an “ad hoc” basis included market volatility, disruption in the China markets, trading halts, suspensions, use of a new pricing methodology, pricing vender or broker, Rule 2a-5, and valuation of Russian/Ukrainian holdings. In the 20th edition, such meetings were conducted as follows:

- 40% full board, audit committee, or valuation committee met live or by phone;

- 40% certain director members of the above committees met live or by phone; and

- 34% certain director members of the above committees made inquiries via e-mail.

Interestingly, Rule 2a-5 requires prompt notification to fund directors in specific instances. Directors may consider acting to ensure that all their expectations around the valuation and escalation process are concisely communicated to management to ensure management is aware of the board’s issue-escalation preferences beyond those highlighted in the Rule. As mentioned above, most survey years had no shortage of events that impact valuations and created price uncertainty. Meeting with and discussing and documenting conversations with management that occur off-cycle from the formal board schedule could go a long way to reduce regulatory risk and demonstrate active oversight by fund directors.

Board Reporting

Perhaps no other area changed more in our survey findings to become an industry trend and best practice than board reporting. Board books filled with data and information began to become more risk-based reports with the emergence of key valuation indicators. These KVIs allowed fund directors to work with management to identify information, data elements, and data analytics that would highlight risks and changes in the fund’s investment holdings; this, in turn, has allowed directors to manage the risk of mispricing when price uncertainty enters the market.

In the 12th edition of the survey, we noted an emerging trend as “9% of survey participants indicated that their boards added valuation risk dashboards or key valuation indicators over the past year to assist in their oversight of the valuation process.” The year was 2014. Eight years later, the 20th edition findings show that 92% of fund boards are receiving summary data and analysis—47% in a valuation risk dashboard format and 45% in a non-dashboard format such as Excel. In either format, risk-/exception-based reporting has arrived and is here to stay, as 50% of fund boards receive two or more pages containing KVIs and analysis, and in 95% of fund groups such information is provided at each board/committee meeting.

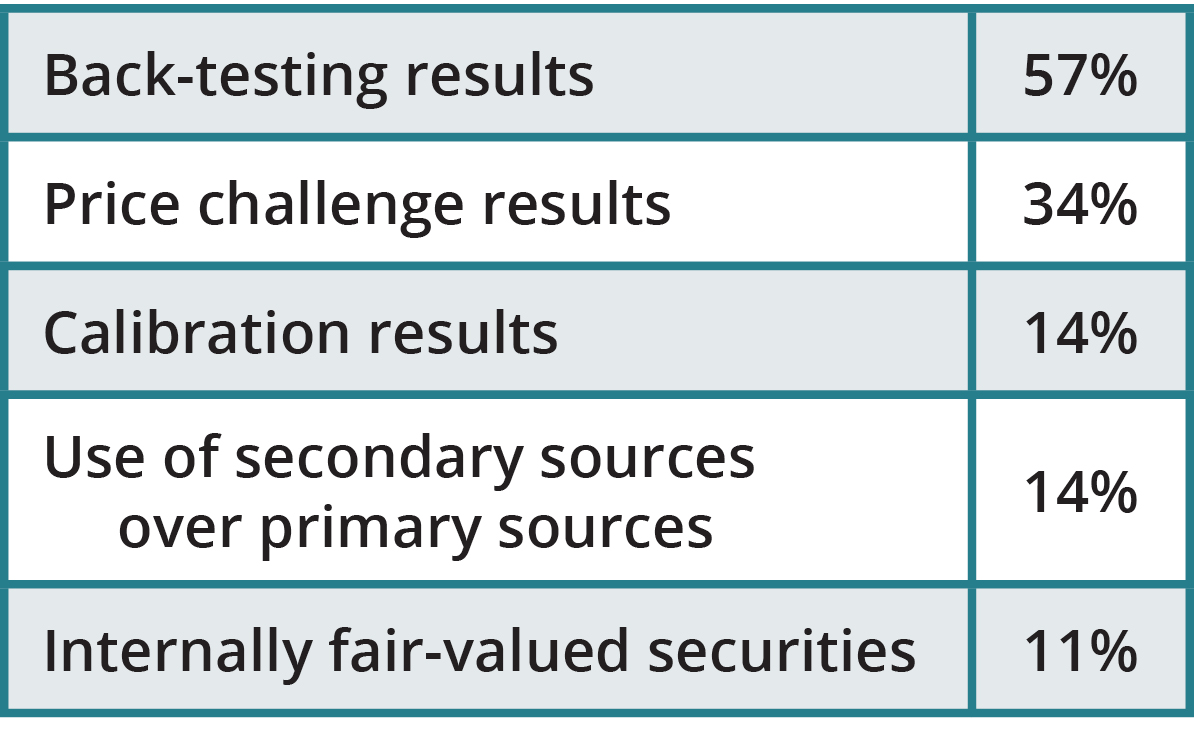

The Rule seems to support the move to risk-based reporting with the emphasis on the completion of a formal risk assessment as part of its focus on active oversight. And the use of KVIs continues to grow with formats that include timeframe trendlines and year-over-year/period comparisons of KVIs becoming the norm. Popular KVIs include:

- Back-testing results of trades

- Unchanged/stale holdings in the portfolio

- Percentage of level 3 holdings in the portfolio

- Broker-priced holding in the portfolio

- Percentage of holding priced using vendor-based pricing

- Number of price challenges/direction or price challenges (up/down)

An emerging-to-maturing trend in the risk-based board reporting area focuses on the inclusion of the full detail behind the summarized reports. In the 20th edition, 34% of fund groups provide no full detail in the board materials when summarized valuation-related reporting has been provided. This is up from 27% in the 19th edition. While fund directors may prefer full details, the absence of such can allow them to focus on the risk-based reporting that is important to overseeing the risk of mispricing.

As noted above, price challenges are a popular KVI, with 74% of fund groups providing the number of price challenges to their boards. This was not always the case: In the 15th edition, it was 67%, and in the 10th edition, it was only 38%. Obviously, the devil is in the details. Beyond the number of challenges lie the reasons for the challenges: Why? What is the direction (up vs down in value)? Does evidence of any management (portfolio manager) bias exist?

Fund governance has changed quite a bit over the 20 editions of the fair valuation survey. Without a doubt, fund directors have spent more time on the valuation operating model, and it seems to be working. A founding tenet of Rule 2a-5 is to explicitly permit fund boards to appoint the investment adviser as its valuation designee in carrying out responsibilities under the Act, and 92% (in the 20th edition) of fund group participants said they were planning to do this. This allowed the industry to solidify the delegation model that existed in practice, as nearly all survey participants indicated that the responsibilities of the boards or one of its committees has essentially remained the same. This suggests that the board oversight model, as it existed before Rule 2a-5, has largely been affirmed. However, the Rule is clear that boards, under the valuation designee model, must practice active oversight that is based on risk, as outlined in the adopting release of the Rule. As a result, we imagine that risk-based reporting will stay evergreen.

The 20th edition of the survey highlighted board reporting areas where work will continue to be done, i.e., where board reporting will increase as a result of Rule 2a-5 (see chart). Thus, the collaboration between management and fund directors and the refining of board reporting is never finished. In addition, a warning as discipline may be required by fund directors to maintain the robust active oversight that has been developed over the past 20 years given the prescriptive nature of Rule 2a-5. Pivoting to the Rule may dampen the collaborative and innovative relationship that we have noted in the survey findings between management and the fund directors as the requirement to provide quarterly, annual and prompt (as required) reporting takes center stage and may dull current and past attention, improvements, and time spent on governance over the valuation policies and procedures and the valuation operating model.

The 20th edition of the survey highlighted board reporting areas where work will continue to be done, i.e., where board reporting will increase as a result of Rule 2a-5 (see chart). Thus, the collaboration between management and fund directors and the refining of board reporting is never finished. In addition, a warning as discipline may be required by fund directors to maintain the robust active oversight that has been developed over the past 20 years given the prescriptive nature of Rule 2a-5. Pivoting to the Rule may dampen the collaborative and innovative relationship that we have noted in the survey findings between management and the fund directors as the requirement to provide quarterly, annual and prompt (as required) reporting takes center stage and may dull current and past attention, improvements, and time spent on governance over the valuation policies and procedures and the valuation operating model.

Paul Kraft is a partner in Deloitte’s Financial Services Industries practice and is the Investment Management Marketplace Eminence Leader. He has over 30 years of experience providing audit, risk and control, and advisory-related services to some of Deloitte’s largest asset management, insurance and bank clients. Paul has led Deloitte’s annual Fair Valuation Survey since inception and is a frequent speaker and writer on the topic of fair valuation, as well as other industry and governance issues. He lives in Massachusetts with his wife Amy, four boys—Gus, Ray, Henry, and Ned—and their dog Huckles.