The investment management distribution landscape is intricate and ever evolving, reflecting the maturity of the industry. Investment managers recognize that there is no one-size-fits-all approach to distribution, leading to the adoption of diverse distribution strategies. In this first in a series of three articles, we begin with an overview of distribution strategy; in upcoming segments, we will explore the current distribution environment and delve into actionable steps to improve a fund board’s oversight of distribution.

The objective of a distribution strategy is clear: Bring products to market, raise assets, foster revenue growth. Yet, achieving these outcomes is a multifaceted and dynamic process. While sales teams come to mind and do play a crucial role, a distribution strategy is an intricate interplay of factors that stem from an adviser’s business vision, as well as the competitiveness of the adviser’s products, and inputs from diverse functions and subject matter experts within the firm.

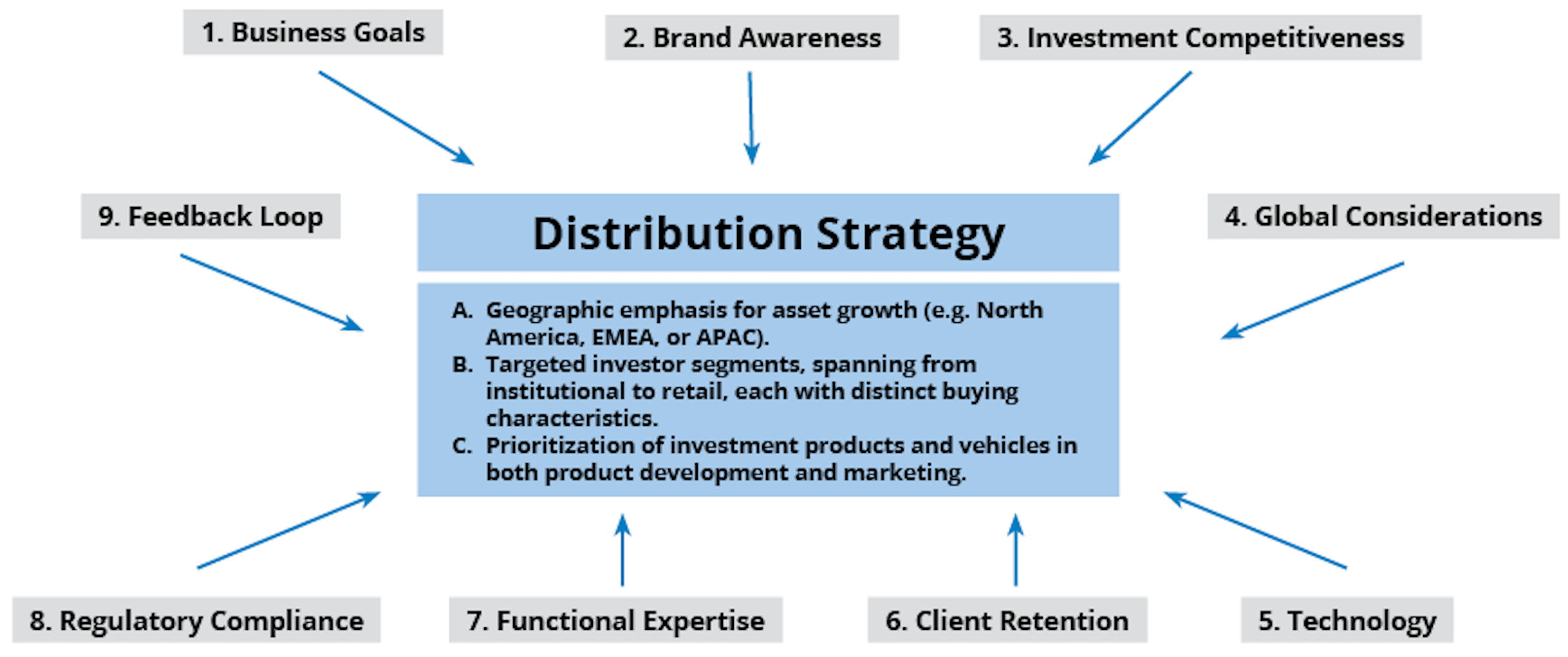

Distribution strategies vary significantly based on the size of the investment manager and the spectrum of investment products they offer. In the case of a multi-product firm with presence in the United States or on a global scale, the chart below provides a visual representation of the factors that collectively contribute to shaping a distribution strategy.

Defining these factors results in a carefully crafted strategy that frames distribution priorities:

- Business Goals—A distribution strategy aligns with the adviser’s broader business vision and direction of the firm. That vision ranges from maintaining market share through established funds to adopting an innovation focus with creative, first-to-market funds. Understanding the business goals and vision helps provide clarity and perspective of a resulting distribution strategy.

- Brand Awareness—How do market participants and investors perceive the adviser’s leadership in the investment industry, taking into account their management talent, portfolio management expertise, regulatory reputation, and client centricity? Acknowledging the brand status of the adviser is crucial when formulating a realistic and successful distribution strategy.

- Investment Competitiveness—The success of distribution relies heavily on the competitiveness of the investment products. This entails a comprehensive grasp of market demands, continuous awareness of industry trends, and the provision of diverse funds or vehicles to cater to the investor needs and preferences. Competitiveness, in this context, is also delineated by a clear and well-defined investment value proposition, the stability of the the portfolio team, peer rankings in terms of risk and return, transparent fee structures, etc.

- Global Considerations—Firms operating globally must navigate complex market dynamics, investor preferences, and regulatory environment, which are all considered in the distribution strategy.

- Technology—The ability to leverage digital technology, data analytics, and client relationship management systems to enhance sales and client experience.

- Client Retention—While new business is a primary goal for growth, especially with product launches, retaining existing clients and mitigating at-risk accounts are crucial steps. Retention may be a high priority if investment performance is challenged, or other market forces are at work.

- Functional Expertise—Distribution is more than just sales professionals. Distribution teams are comprised of marketing, sales, and client service staff with deep expertise in specific market segments or investment products, all supported by an assortment of subject matter experts in operations, legal, etc.

- Regulatory Compliance—Navigating and adhering to the the regulatory framework across all jurisdictions where the adviser conducts business is paramount. The commitment to compliance with regulations not only ensures legal adherence but also plays a pivotal role in shaping and upholding the adviser’s brand reputation.

- Feedback Loop—Continuous assessment and evaluation of the distribution strategy to adapt to client dynamics, asset flows, and new business potential. The sales pipeline and asset flows are influenced heavily by changing capital market conditions, the geopolitical environment, and evolving investor objectives, all which are monitored.

Adaptability, Strategic Thinking

Once a strategy is outlined, some firms opt for a multifaceted distribution approach, utilizing both internal teams and external intermediaries or other third parties. These teams will then collaborate or perhaps overlap in their efforts. For large firms, well-coordinated campaigns come into play, incorporating sales, client service, and marketing expertise. Notably, marketing groups assume a pivotal role in content development, facilitating product promotion and education through various channels such as webinars, white papers, pitch books, and investor surveys.

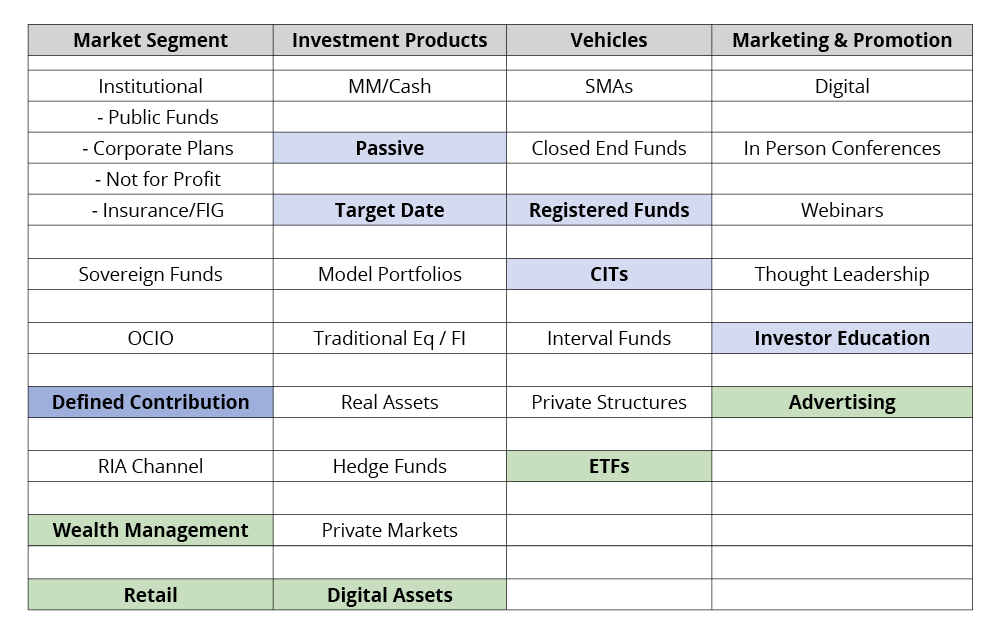

Distribution campaigns may focus on a singular investment fund, such as money market, private credit, or digital assets funds. Conversely, other campaigns may target specific investor segments, presenting a range of investment funds tailored to meet specific needs. This complex landscape of investor segments, vehicles, and products underscores the adaptability and strategic thinking employed by investment managers in distribution management (see chart below).

Example 1, Defined Contribution: A campaign focusing on corporate defined contribution plans, specifically highlighting target-date funds and passive funds. The emphasis extends to both registered funds and collective investment trusts, employing an approach centered around investor education for marketing and promotion purposes.

Example 2, Wealth Management: A campaign promoting digital asset exchange-traded funds to wealth management and retail investors through advertising, with the primary goal of boosting sales by highlighting distinctive features and benefits.

In the Boardroom

For fund boards, which are of course responsible for governance and oversight, it is crucial to understand how a specific fund complex is handled from a distribution perspective. Questions arise around the existence of dedicated sales teams, marketing initiatives, and client service groups focused on raising assets for their funds and ensuring effective investor servicing. Fund boards are not managing the day-to-day operations. Nonetheless, having a clear understanding of the process of how funds are being sold and through which market segment is an important step in fulfilling oversight responsibilities.

Board members who want to delve deeper into understanding the nuances of the distribution strategy, with the aim of establishing or enhancing a robust distribution oversight framework, can think about starting with some, or all, of these questions to get the conversation started:

- What is the adviser’s process of establishing a distribution strategy? Which segments are being pursued? Which vehicles are being launched?

- How is this process aligned to the adviser’s product management strategy, marketing strategy, compliance, risk management, operations, and other business functions?

- What process is in place to monitor how a product is sold? What policies and procedures are in place to ensure alignment with the overall distribution and business plan?

- What are the potential risks or conflicts (compliance, regulatory, legal) associated with having separate distribution strategies for different products, vehicles, or market segments? Furthermore, what process is in place to monitor and mitigate these risks and opportunities?

- In anticipation of remaining competitive and driving growth, what adjustments are foreseen in the current distribution plan? This includes the use of third parties, changes in compensation structure, shifts in market segment focus, and the introduction of new client services.

- What measures are in place to identify and monitor the risks associated with any distribution strategy changes?

Stay tuned for the next installment. We will review the current distribution environment and the necessary governance and oversight considerations.

John Krieg is an experienced fund director and investment executive with 35 years of experience and professional investor qualifications. He served as an interested trustee on the UBS Asset Management Collective Investment Trust board, overseeing a complex funds across passive, active, money market, multi-asset, and alternative strategies; his oversight and governance experience includes fund launches and closures, the contract renewal process, fair valuation determination, and liquidity events. Krieg’s most recent professional role was as a managing director and head of institutional distribution for North America with UBS Asset Management, where he also served on the UBS Global Client Coverage Management Committee. He holds the CFA and CAIA Charters, the CFA Institute Certificate in ESG Investing, and completed the Certified Investment Fund Director (CIFD) program.