In 2015, our Simpson Thacher colleagues contended that recruiting younger directors could lead to more diverse fund boards, while also recognizing the inherent challenges involved in identifying a diverse pool of candidates. In light of the changing demographics of fund boards (or, more accurately, a lack thereof in certain respects), regulatory developments in diversity initiatives, and the hybrid work environment that developed in response to the COVID-19 pandemic, we believe that a refresh of our prior article is warranted at this time. To be clear, this article is not focused on arguing the merits of increased diversity on fund boards nor suggesting that a diverse board candidate should be selected over a non-diverse board candidate that is otherwise the most suitable candidate for the position. Instead, we are advocating for a different approach to the traditional board candidate search process, which theoretically could lead to a more diverse fund board that better aligns with an increasingly diverse shareholder base and general population.

We first provide an update on the statistics that we reported 10 years ago, highlighting that fund boards still lag the diversity seen in both the general U.S. population and the mutual fund investor base. Then, in order to address the enduring lack of fund board diversity, we continue to urge fund boards to consider an “either/or” approach, coupling retirement ages with term limits to address the hesitancy that fund boards may experience when considering younger candidates and dispelling the myth of the retired director. Finally, we believe that fund boards should not only consider younger candidates to improve a board’s diversity, but also a wider variety of professional experiences compared to those typically seen in board candidates (i.e., backgrounds and professions that go beyond legal, finance, and academia). This endeavor could bring fresh, new perspectives to the fund boardroom.

We first provide an update on the statistics that we reported 10 years ago, highlighting that fund boards still lag the diversity seen in both the general U.S. population and the mutual fund investor base. Then, in order to address the enduring lack of fund board diversity, we continue to urge fund boards to consider an “either/or” approach, coupling retirement ages with term limits to address the hesitancy that fund boards may experience when considering younger candidates and dispelling the myth of the retired director. Finally, we believe that fund boards should not only consider younger candidates to improve a board’s diversity, but also a wider variety of professional experiences compared to those typically seen in board candidates (i.e., backgrounds and professions that go beyond legal, finance, and academia). This endeavor could bring fresh, new perspectives to the fund boardroom.

Exactly 10 years ago, on Oct. 20, 2015, FBV ran its second-ever Viewpoints article, one in which Rajib Chanda and Christopher Healey of Simpson Thacher argued that “the difficulty boards have in identifying candidates stems from one particular criteria used by the vast majority of mutual fund boards that unnecessarily limits the number of qualified diverse candidates for open board positions: Age.” They presented compelling reasoning, and we thought it would be interesting to check back in and see how things have changed, and stayed the same, 10 years on. Read the original article here.

Current Board Diversity

It remains as true today as it did in 2015 that the average fund board is unlikely to reflect the diversity seen in the shareholder base and the U.S. population generally, which is increasingly becoming more diverse. As of the end of 2024, the average fund board member was 68 years old, a three-year increase from an average age of 65 years old in 2015, with a retirement age of 75 (compared to 72 in 2015).[1]

Since our last article, two areas of improvements with respect to the composition of both fund and corporate boards relate to gender and racial diversity. With respect to fund boards, as of the end of 2024, 39% of independent directors identified as female (up from 24% in 2015), with 38% of new independent directors identifying as female, and 18% of independent directors identified as non-white (up from 8% in 2015), with 12% of new independent directors identifying as non-white.[2]

This trend is also true for corporate boards, with 34% of board members identifying as female in 2024 (up from 18% in 2015), and 42% of new directors identifying as female last year.[3] One study by the National Bureau of Economic Research found that more women were appointed to U.S. corporate boards as a result of certain large asset managers launching a campaign in 2017 to boost female membership on boards, showing the power that asset managers can have on the broader makeup of corporate boards.[4] While data on the racial makeup of corporate boards is scarce, one study found that at the end of 2012, around 55% of U.S. public companies had no racial minorities represented on their boards of directors, and fewer than 20% had more than one minority director.[5] By 2022, while almost half of U.S. public companies had at least two minorities on their boards, 20% still had boards comprised solely of white directors.[6] It is clear that racial minorities remain significantly underrepresented on boards, despite this shift in more recent years.[7]

While new board members can better represent the average fund investor in some respects,[8] the overall composition of boards still does not align with the diversity seen in the general U.S. population and among fund investors. Women continue to make up about half of the population,[9] and there has been a significant increase over time in the number of married women making financial and investing decisions (for instance, a 30% jump from 2015 to 2020).[10] What’s more, the number of women interested in investing has increased by 50% since the COVID-19 pandemic.[11]

In addition, both fund investors and the U.S. population overall are becoming increasingly more diverse, with now 29% of fund investors (up from 21% in 2015) and 42% of the U.S. population (up from 38% in 2015) identifying as racial minorities.[12] Projections released by the U.S. Census Bureau suggest that the U.S. population will continue to be younger and more racially and ethnically diverse, signaling that boards will continue to lag unless they take steps to increase the diversity of their members.[13]

Diversity Initiatives

In addition to corporate America broadly, the funds industry has implemented diversity initiatives. In 2015, we noted that Item 407(c)(2)(vi) of Regulation S-K requires that registered funds disclose in proxy statements related to board election diversity considerations and policies (if any). That requirement remains in effect. Since then, there has been only one significant diversity initiative adopted by regulators in the fund industry. In May 2019, the New York Stock Exchange created the NYSE Board Advisory Council in order to increase both gender and racial diversity by identifying qualified candidates from underrepresented groups for boards of NYSE-listed firms, which would presumably also cover funds listed on the NYSE.[14] The Council, which currently has 23 members, includes senior executives from well-known corporations such as Delta, The New York Times, and Uber who use their networks to identify diverse board candidates.[15] It is worth noting that use of the NYSE Board Advisory Council is entirely voluntary for NYSE-listed firms and, similar to Regulation S-K, it is an initiative that may increase diversity on a fund board but does not outright require it.

To contrast the above, there have been other proposed board diversification initiatives that never went into effect and are unlikely to do so in the future. In 2021, the Securities and Exchange Commission approved a proposed Nasdaq board diversity rule that required Nasdaq-listed firms to (i) disclose annually their board-level diversity statistics using a standardized format that included how directors self-identify regarding gender, race, ethnicity, and LGBTQ+ status, and (ii) either have diverse directors or explain why they do not have a diverse board.[16] Initially, a three-judge panel for the U.S. Court of Appeals for the Fifth Circuit upheld this rule.[17] However, in December 2024, the full Fifth Circuit vacated the SEC’s order approving Nasdaq’s Board Diversity Proposal, finding that the SEC exceeded its authority under the Securities Exchange Act of 1934, as amended.[18] In addition, although an advisory sub-committee of the SEC suggested in 2021 that mutual fund boards be required to disclose information about gender and race diversity of their members,[19] this has not led to any particular disclosure requirements being implemented by the SEC.

Youth, Diversity, the ‘Retired’ Director

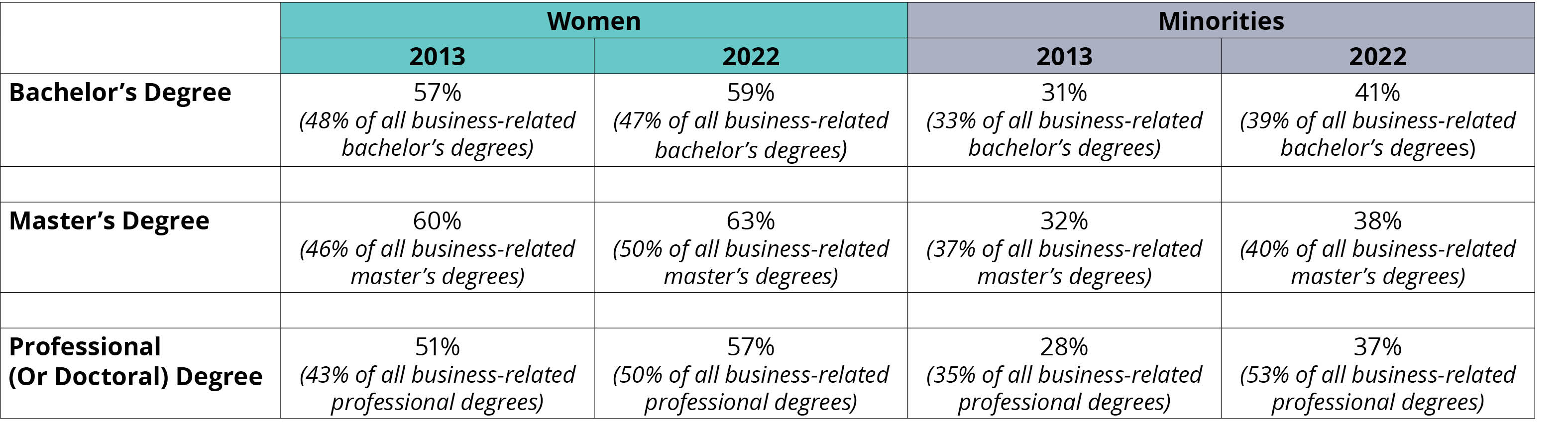

As was true in 2015, there continues to be a trend of women and minorities making up a greater proportion of the educated population, including with respect to master’s and professional degrees.[20] This supports our original view that there remains a plethora of qualified candidates that are younger and also diverse, whereas decades ago women and minorities made up only a small portion of those with college degrees.

It goes without saying that fund board membership involves a significant time commitment, and that has not changed since our original article. As of the end of 2024, more than half of fund board members identified as retired from their professional career, versus about one-third who work full-time.[21] This is in sharp contrast to data from 2013 showing that 32% of fund board members identified as retired versus 46% as active full-time employees.[22] Interestingly, only about 11% of fund boards reported that a director candidate’s “retired or semi-retired status” was a primary consideration for their selection, whereas 35% of fund boards said diversity was a primary consideration.[23] This data indicates that there is a shift toward considering younger professionals as potential board candidates, although fund board demographics would show otherwise.

During the COVID-19 pandemic, the SEC staff provided relief from the in-person meeting requirements under the 1940 Act, which resulted in more acceptance of virtual fund board meetings. In fact, some fund boards continue to rely on the in-person board meeting relief, with approximately 28% of boards reporting that some previous in-person meetings are now held by tele- or video-conference.[24] As such, we do not believe that concerns about time commitment required for board membership should dissuade fund boards from considering qualified candidates who are actively employed, even on a full-time level, and expect to continue to be for a number of years.

In addition to new fund directors being more professionally active, we believe there has been a more recent push for fund boards to appoint “new gen” directors (those under the age of 50) that can serve on the board for decades, theoretically. That being said, fund board directors that are at retirement age have been remaining on boards longer. In addition, retirement policies with an older mandatory retirement age, coupled with some boards having a mandatory retirement waiver mechanism, may be supporting the older average age on boards. These two trends have balanced each other out, resulting in the average age of all fund independent directors remaining essentially unchanged from previous years.

Despite 76% of fund complexes having a mandatory retirement policy, only 7% of fund complexes also have a policy that limits the number of years a director may serve (with the average length of such term limit being 16 years).[25] Notably, the average mandatory retirement age has increased from 72 years old in 2015 to 76 in 2025.[26] Despite these policies, we see a number of fund complexes with official or unofficial mandatory retirement age “waivers” that allow board members to continue to serve for a number of years after reaching the mandatory retirement age. Such waivers allow boards to delay consideration of new candidates that may be able to increase the diversity of their membership.

What Can a Board Do?

We believe that in order to address the lack of diversity on fund boards, boards should consider the “either/or” approach that couples age limits with term limits. Although there has been an increasing number of boards that have adopted term limits, the overwhelming majority of boards have not. We also urge boards to consider either discontinuing granting discretionary waivers to board members who have hit the mandatory retirement age or limiting the number of waiver periods.

In addition to considering younger candidates as a way of expanding the pool of diverse, qualified candidates, we suggest fund boards consider candidates who do not have prior senior executive or corporate directorship experience and even those outside of the asset management industry. In 2025, 39% and 32% of boards report financial services industry experience and mutual fund industry experience, respectively, as a primary consideration in selecting a candidate.[27] In addition, 88% of boards report financial accounting/audit experience as being a primary consideration in selecting a candidate.[28] While a fund is required to disclose whether its board has an “audit committee financial expert” to satisfy certain SEC requirements, the board’s other audit committee members, and the overall board, do not necessarily need to meet the same qualifications and can have financial literacy through other experiences. Examples of candidates who are not traditionally considered for fund boards, but could be, include educators, technology professionals, consultants, trade association leaders, business owners, and non-profit board members.

While considering other professional experiences for potential board candidates will broaden search efforts, it will only identify underrepresented candidates to the extent the search goes beyond the personal networks of current directors and management. For funds that are listed on NYSE or Nasdaq, we encourage those fund boards to take advantage of the NYSE Board Advisory Council and Nasdaq’s complementary recruiting service, respectively, to assist with locating diverse candidates. While not all these candidates will be appropriately qualified to serve on a fund board with its regulatory overlay and scrutiny, recruiting services may serve as a useful alternative to the traditional approach to tapping into current board members’ networks.

In addition, we suggest expanding recruiting networks to other institutions and organizations that have a track record of identifying high-performing, underrepresented candidates. Examples of networks worth considering include historically black colleges and university boards, leadership and alumni, affinity groups at U.S. corporations and institutions, and organizations for underrepresented professionals. We’ve seen corporations partner with HBCUs to develop a pipeline for diverse talent, which can serve as an example for asset managers looking to diversify their fund boards.[29]

Anne Choe (pictured, left) is a partner in Simpson Thacher’s Registered Funds and Asset Management Regulatory and Enforcement Practices and represents investment managers, registered funds, and private funds on a broad range of regulatory and transactional matters. Her experience covers a variety of fund structures, including exchange-traded funds, mutual funds, closed-end funds and private funds, and she regularly counsels family offices and independent boards.

Debbie Sutter (pictured, right) is counsel in the Registered Funds Practice, focusing on a broad range of investment management issues related to registered funds, registered investment advisers, and fund boards. She advises asset management firms on the operation and formation of investment funds, including interval funds, listed closed-end funds, and business development companies.

Associates David Jennings and Clarence Jenkins and 2025 Summer Associate Taryn Pastore provided valuable assistance with this article.

Rajib Chanda, global head of asset management at Simpson Thacher, and Christopher Healey, then-associate at Simpson Thacher, wrote the 2015 Viewpoints article and inspired this update.

[1] See Mutual Fund Directors Forum (mfdf), Mutual Fund Director Compensation: The 2025 Management Practice Annual Survey, May 21, 2025.

[2] Independent Dir. Council, 2025 Directors Practices Study: Practices and Compensation (Aug. 2025).

[3] Matteo Tonello, Board Practices and Composition: 2024 Edition, Harv. L. Sch. F. Corp. Governance (Dec. 12, 2024), https://corpgov.law.harvard.edu/2024/12/12/board-practices-and-composition-2024-edition/.

[4] See Todd A. Gormley, et al., The Big Three and Board Gender Diversity: The Effectiveness of Shareholder Voice (Nat’l Bureau Of Econ. Rsch., Working Paper 30657, Nov. 2022, revised April 2023), https://www.nber.org/papers/w30657.

[5] See Vicki L. Borgan, et al., What Drives Racial Diversity on U.S. Corporate Boards? Mandates or Movements, Cornell SC Johnson Coll. of Bus. (Jan. 2025), https://download.ssrn.com/2025/3/13/3952897.pdf.

[6] Id.

[7] Id.

[8] In 2024, 16% of mutual fund investors were younger than 35 with the largest age group of investors being between 35 and 54, who made up 53% of mutual fund owning household heads. See Sarah Holden, Daniel Schrass & Michael Bogdan, Characteristics of Mutual Fund Investors, Inv. Co. Institute: ICI Research Perspective, Oct. 2024, Vol. 30, No. 9. Available at: https://download.ssrn.com/2025/6/2/5279213.pdf.

[9] U.S. Census Bureau, Quick Facts: United States, Female persons, percent, https://www.census.gov/quickfacts/fact/chart/US/SEX255223 - SEX255223 (last visited July 10, 2025).

[10] Marguerita Cheng, Women and Investing: Statistics Show Progress, Not Parity, U.S. News (Aug. 19, 2024), https://money.usnews.com/financial-advisors/articles/women-and-investing-statistics-show-progress-not-parity.

[11] Id.

[12] Daniel Schrass & Michael Bogdan, ICI Research Report, December 2024, Profile of Mutual Fund Shareholders, 2024 (Dec. 2024), https://www.ici.org/system/files/2024-12/24-rpt-profiles.pdf; U.S. Census Bureau, Quick Facts: United States, White alone, not Hispanic or Latino, percent, https://www.census.gov/quickfacts/fact/chart/US/RHI825223 (last visited July 10, 2025); US population by year, race, age, ethnicity, & more, USAFacts: DATA GUIDES, https://usafacts.org/data/topics/people-society/population-and-demographics/our-changing-population/?endDate=2016-01-01&startDate=2015-01-01-racial-ethinic-population-change (last visited July 10, 2025).

[13] Press Release, U.S. Census Bureau, U.S. Population Projected to Begin Declining in Second Half of Century (Nov. 9, 2023), https://bit.ly/42KfiiM.

[14] Exchange in Focus: NYSE advancing board diversity, Sustainable Stock Exchanges Initiative (June 26, 2019), https://sseinitiative.org/all-news/exchange-in-focus-nyse-advancing-board-diversity (last visited Oct. 13, 2025).

[15] New York Stock Exchange, NYSE Board Services, https://www.nyse.com/board-services (last visited July 9, 2025).

[16] SEC, The Nasdaq Stock Market LLC Rules, https://www.sec.gov/files/rules/sro/nasdaq/2020/34-90574-ex5.pdf.

[17] All. for Fair Bd. Recruitment v. Sec. & Exch. Comm'n, 85 F.4th 226, 240 (5th Cir. 2023).

[18] All. for Fair Bd. Recruitment v. Sec. & Exch. Comm'n, 125 F.4th 159, 166 (5th Cir. 2024).

[19] Gilbert A. Garcia, et al. Subcommittee on Diversity and Inclusion, SEC Asset Management Advisory Committee, Recommendations for Consideration by the AMAC on July 7, 2021, https://www.sec.gov/files/amac-recommendations-di-subcommittee-070721.pdf (last visited July 9, 2025).

[20] Nat'l Ctr. for Educ. Stat., Digest of Education Statistics, List Of Tables And Figures, Chapter 3. Postsecondary Education, tables 318.10, 318.30, 322.20, 322.30, 323.20, 323.30, 324.20,324.25, https://nces.ed.gov/programs/digest/current_tables.asp (all percentages were calculated using the graduation year listed in the table and with only U.S. residents) (last visited Oct. 10, 2025).

[21] Supra note 2.

[22] See Inv. Co. Instit. Considerations for Board Composition: From Recruitment Through Retirement, (Oct. 2013), http://www.idc.org/pdf/pub_13_considerations_board_comp.pdf.

[23] Supra note 2.

[24] Id.

[25] Id.

[26] Id.

[27] Id.

[28] Id.

[29] E.g., Shelly Brown, Matthew Finney, Mark McMillan, & Chris Perkins, How to close the Black tech talent gap, McKinsey Institute for Black Econ. Mobility (Feb. 3, 2023), https://www.mckinsey.com/bem/our-insights/how-to-close-the-black-tech-talent-gap (last visited July 9, 2025).