Meyrick Payne of management consultant and data provider Management Practice Inc. retired this year from the firm he founded more than 40 years ago. While Stamford, Conn.-based MPI’s work initially focused on the contract renewal process, it grew to include consultation concerning the dynamics of the board itself, fee negotiation, and trustee compensation and benefits. During his long professional career, which included stints at KPMG Peat Marwick and McKinsey & Co., as well as a CFO role, Payne was an active and sought-after member of the mutual fund and fund governance communities, serving as an expert witness on behalf of fund boards and overseeing the publication of “The Uneasy Chaperone: A Resource for Independent Directors of Mutual Funds.” Always keen to make fund board service relatable, Payne also developed three playlets—“Hear My Voice,” “So, You Want to be a Mutual Fund Director?” and “What Shall We Do Now?”—to be performed for mutual fund boards. In retirement, he plans to keep sailing and go where the wind takes him (metaphorically speaking).

Here, Payne looks back on some of the significant issues that have faced fund boards over the past four decades.

For decades, mutual fund directors have provided reassurance to investors that their savings and investments are handled fairly and without major scandals. The success of mutual funds from the early 1970s, when there was less than $50 billion in assets under management, to today, with more than $26 trillion, indicates that all aspects of the fund system are working well. However, the nature of fund directors’ job has changed markedly over that time.

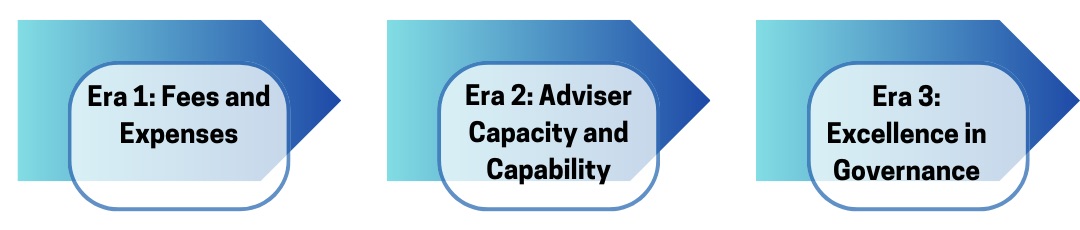

Era 1: Fees and Expense (c. 1972 to 1995)

During the years from the early 1970s to the mid-1990s, the primary emphasis for directors was fees and expenses, and much of the contract renewal process was about breakpoints in the advisory fee. Assets grew quickly, and directors were obliged to pass along economies of scale. The board had—and still has—a responsibility to ensure that the securities in the funds they oversee are correctly priced.

When the Gartenberg ruling was handed down in 1982, fund directors promptly added “profitability” to the other fee-related factors they already were considering (adviser costs, fallout benefits, service provider expenses, sub-adviser fees, etc.) on their list of priorities, which also included verification of 12b-1 fees and assurance that funds qualified as partially tax exempt. Naturally, part of the process is selecting a suitable peer group for analyses.

Meanwhile, the regulatory process under the Securities and Exchange Commission has become more rigorous and that, together with the legal exposure exemplified by the spate of lawsuits brought under Rule 36(b) in recent years, has heightened attention on the role of fund directors. However, changing times also have fostered competitive pressures that have driven total expense ratios lower.

Era 2: Adviser Capacity and Capability (c. 1996 to 2024)

The same competitive pressures have brought about huge changes in the structure of mutual funds, pushing derivatives, complex trading strategies, indexing, tax minimization, and maturity-based investments to the fore. Simultaneously, the product offerings in a mutual fund wrapper have exploded, with everything from closed-end and interval funds to business development corporations and inverse/reverse funds (which are often highly leveraged) introduced to the market.

These developments have necessitated that fund directors verify that the adviser has both the capability and the capacity to bring such complex funds to market. Imbedded in the Gartenberg rules is the requirement that fee comparison between mutual funds and other parallel offerings from the adviser are examined.

Fortunately, the SEC saw fit to add to the resources of fund directors with a chief compliance officer, a fund financial expert, and the authority to retain outside experts to assist them, particularly in the fields of best execution, soft-dollar usage, derivatives, and liquidity. Fund directors have always had the responsibility to hire independent auditors, which also augment the board’s resources.

During this era, the fund industry consolidated into fewer families, which has added to directors’ responsibilities the need to oversee any change of control. This requires assuring investors that the acquiring adviser can provide the same capability at a comparable price. Additionally, several crises occurred during this era, thereby requiring fund directors to oversee a tech bubble, a liquidity crunch, market timing, front running, and runs on money market funds.

Era 3: Excellence in Governance (ongoing)

The increases in director responsibilities, the heightened legal and regulatory exposure, the consolidation of the industry have all added to the job complexity and thus to a fundamental change in the way in which governance is conducted.

Today’s boards are often smaller, with fewer directors overall but increased skill requirements, all while the board must maintain independence and strive for more diversity. The time requirements for fund directors have expanded from four meetings a year to a virtually full-time commitment of year-round vigilance. Competition to attract, motivate, and retain fund directors has increased as corporate boards seek many of the same candidates. And the process of hiring a new director has increasingly moved away from who-the-current-directors-know toward professionally managed searches. As a result, directors’ compensation has grown from an average of less than $50,000 in the 1980s to more than $200,000 today, with the group of directors overseeing the largest fund complexes receiving an average of over $400,000 annually.

Mutual fund boards will continue to consolidate, reducing the overall number of directors, but they are likely to home in on professionalism, analytical rigor, and even technological awareness as the industry becomes more automated with blockchain, artificial intelligence, and fully integrated systems. And, of course, fund directors must always stand ready to oversee any crisis that comes along.