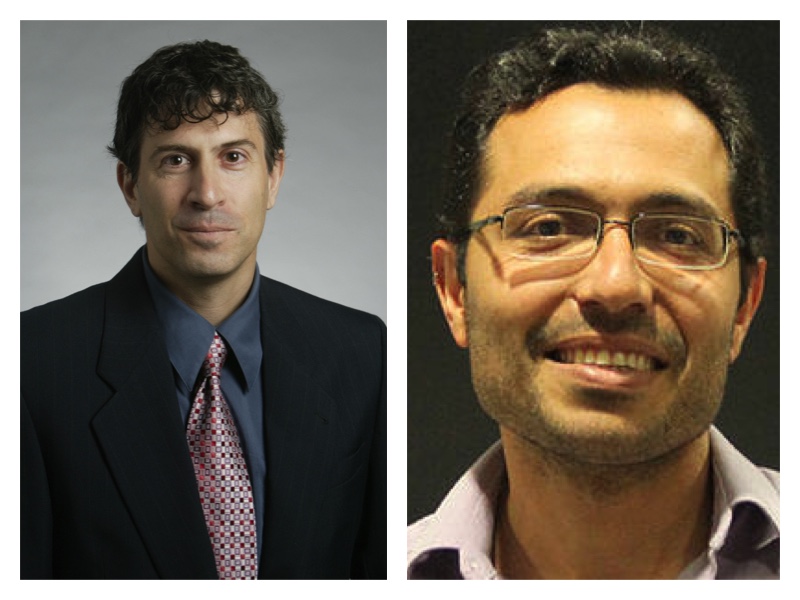

In a recent paper, University of Rochester researchers Ron Kaniel (pictured left) and Robert Parham (pictured right) examine the impact of media attention on consumer and mutual fund investment decisions. Following is the abstract from the piece:

We exploit a novel natural experiment to establish a clear causal relation between media attention and consumer investment behavior. Our findings indicate a 31% local average increase in quarterly capital flows into mutual funds mentioned in a prominent Wall Street Journal “Category Kings” ranking list, compared to those funds which just missed making the list. This flow increase is about seven times larger than extra flows due to the well documented performance-flow relation. Other funds in the same complex receive substantial extra flows as well, especially in smaller complexes. There is no increase in flows when similar information is conveyed absent the prominence of the Category Kings lists. We show mutual fund managers react to the incentive created by the media effect in a strategic way predicted by theory, and present evidence for the existence of propagation mechanisms including increased fund complex advertising subsequent to having a Category King and increased efficacy of subsequent fund media mentions.

To read the paper in its entirety, click here.